TERMS & CONDITIONS

Summary: Acceptance of airpay rafiki terms and conditions

- Before using the Services, it is imperative that you carefully read and comprehend the Terms and Conditions outlined in this Agreement. These terms govern your use of the App, the Services, and the functioning of your Account. A comprehensive list of Defined Terms can be found in Section 20.

- Upon downloading the App and creating an Account, you are agreeing to adhere to and be bound by these Terms and Conditions that oversee the provision of Services. Clicking the "Accept" button within the App affirms your acceptance and agreement to abide by this Agreement. If you disagree with these terms, please refrain from clicking "Accept." It is important to note that without clicking "Accept," you will not be able to access the Services or obtain a license to use the App.

- In the event of any alterations to these Terms and Conditions, we will notify you at least thirty (30) days before the changes become effective. Notifications will be communicated through the App, our social media platforms, our website, and/or via SMS/email. Your continued use of the Services implies your consent to be bound by any modifications to our terms and conditions.

- These Terms and Conditions should be read in conjunction with the Privacy Policy and the Privacy Notice for the App and the Services. By downloading the App and creating an Account, you are also agreeing to comply with and be bound by these documents.

- By utilizing the App or any of the Services, you are granting us permission to collect and utilize technical information regarding the Equipment and related software, hardware, and peripherals for internet-based or wireless Services, with the aim of enhancing our products and providing Services to you.

- Your use of the Services implies your agreement and consent for airpay rafiki, our affiliates, and licensees to process and utilize the data you provide during the application process. This may be done to determine credit scoring services or to enhance our Services and/or your experience with the App, in accordance with the Privacy Policy and Privacy Notice.

- Details regarding our Credit Advances and Charges can be found in Section 6, while the repercussions of defaulting on a Credit Advance and Charges are outlined in Section 7.

- You can reach out to airpay rafiki at any time through the App or via email at care@airpay.tz. If you wish to opt out of receiving direct marketing communications, please contact us at care@airpay.tz. Further details can be found in Section 10.

- Scope

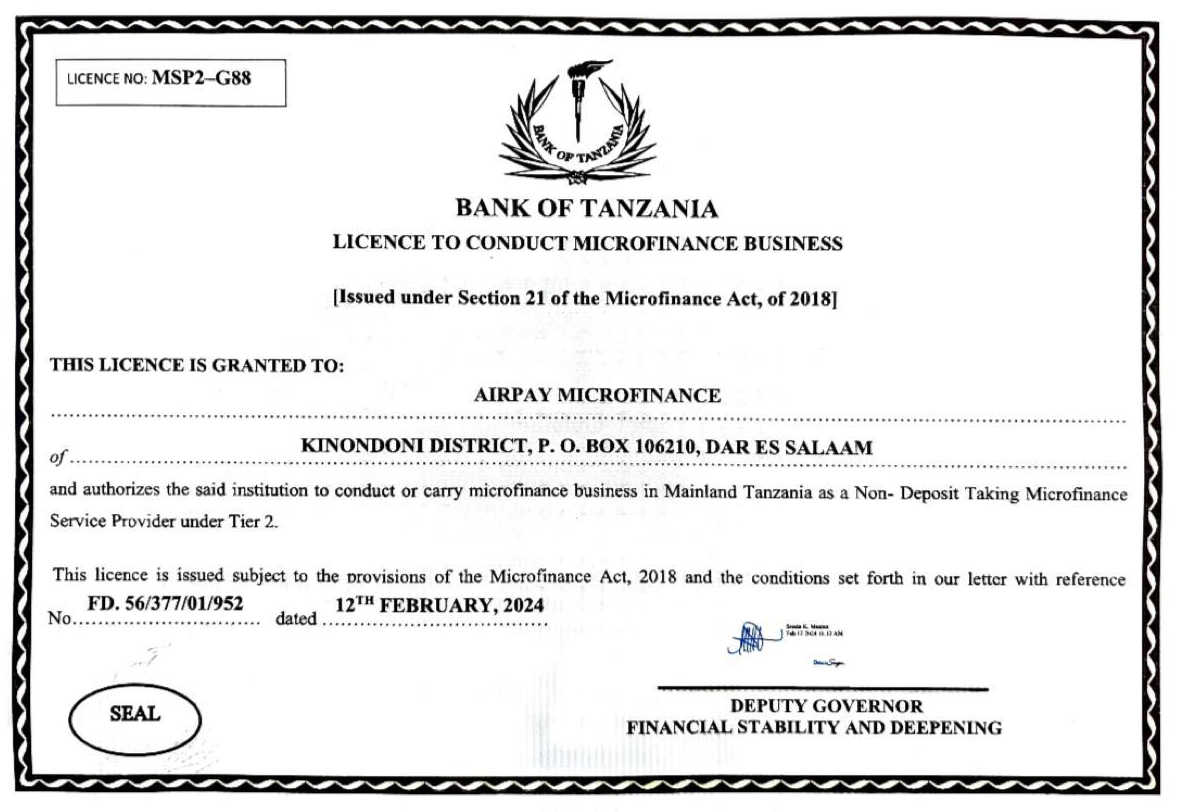

- This Agreement constitutes a financial services and end-user license agreement between the individual who registered with and utilized the airpay rafiki Mobile Lending App using their duly registered mobile phone number, Personal Data, and other details ("airpay rafiki Customer" or "User" or "You"), and InVenture Capital Corporation, a California corporation, its Tanzanian subsidiary InVenture Mobile Limited, and other subsidiaries in Tanzania (collectively referred to as "airpay rafiki"), which offers the airpay rafiki Android application ("airpay rafiki App" or "App") for mobile-based Credit Advances ("We / airpay rafiki / Us”).

- In exchange for your agreement to adhere to the terms of this Agreement, we grant you a non-transferable, non- exclusive license to use the App on your Equipment, subject to the terms of this Agreement. All other rights are reserved by us

- Unless expressly stated in this Agreement, you agree not to:

- Rent, lease, sub-license, loan, translate, merge, adapt, vary, or modify the App.

- Make alterations or modifications to the whole or any part of the App, or allow the App to be combined with or incorporated into any other programs.

- Disassemble, decompile, reverse-engineer, or create derivative works based on the whole or any part of the App, except to the extent that such actions are necessary for achieving interoperability with another software program. In such cases, you must ensure that the information obtained is:

- Not disclosed or communicated to any third party without our prior written consent.

- Not used to create software substantially similar to the App

- Include our copyright notice on all copies of the App you make.

- Provide or make available the App (including object and source code) in any form to any person without our prior written consent.

- You also agree to comply with all technology control or export laws and regulations applicable to the technology used or supported by the App or any Services, in addition to the License Restrictions.

- License RestrictionsYou are prohibited from:

- Using the App or any Service unlawfully or for any unlawful purpose, or in a manner inconsistent with this Agreement, or engaging in fraudulent or malicious activities such as hacking, inserting malicious code, viruses, or harmful data into the App, any Service, or any operating system.

- Infringing on our intellectual property rights or those of any third party in relation to your use of the App or any Service, including the submission of any material that is not licensed by this Agreement.

- Transmitting material that is defamatory, offensive, or otherwise objectionable in relation to your use of the App or any Service.

- Using the App or any Service in a manner that could damage, disable, overburden, impair, or compromise our systems, security, or interfere with other users.

- Collecting or harvesting information or data from any Service or our systems, or attempting to decipher transmissions to or from the servers running any Service.

- You recognize that all global intellectual property rights associated with the App and the Technology are owned by airpay rafiki or our licensors. You understand that your rights to the App are provided through a license and not a sale, and that you do not possess any rights to the App or the Technology, except for the right to use them in accordance with the provisions of this Agreement. You further acknowledge that you are not entitled to access the source code of the App.

- Our Services are exclusively available for individuals aged 18 and above. airpay rafiki retains the authority to authenticate the legitimacy and status of your Mobile Money Account with the relevant Mobile Money Provider.

- The confirmation of your Credit Advance application approval will be presented on the App. You hereby acknowledge and agree that our approval of your Credit Advance application does not establish any contractual relationship between you and us beyond the Terms and Conditions governing your Mobile Money Account at any given time.

- The terms associated with the Credit Advance and the applicable charges for each Credit Advance application will be presented to you on the App before you confirm acceptance.

- We hold the discretion to reject your application for a Credit Advance at our sole and absolute discretion, without the obligation to provide a reason, except through a simple notification that may be displayed on the App.

- We retain the right (exercisable at our sole and absolute discretion) to grant or deny a Credit Advance, and/or adjust the terms of any offer made by us to you for a Credit Advance based on our evaluation of your credit profile from time to time.

- airpay rafiki places a high priority on safeguarding the privacy of information provided by users of its App. We handle your Personal Data and Relevant Information in accordance with our Privacy Policy and the Personal Data Protection Act, 2022. We encourage you to review our Privacy Policy and the App's Privacy Notice, as they outline the consents we may require from you and detail how we collect, use, store, and share your Customer Information. In addition to the links provided in this Agreement, copies of the Privacy Policy and Privacy Notice can also be found. You may also request copies of these documents and these Terms and Conditions by contacting us via email at care@airpay.tz.

- The terms outlined in airpay rafiki's Privacy Policy and Privacy Notice are integrated into the Terms and Conditions of this Agreement. By downloading the App and selecting the "Accept" option regarding these Terms and Conditions, you confirm that you have also read and comprehended the provisions of the Privacy Policy and Privacy Notice.

- airpay rafiki gathers and processes personally identifiable information (Personal Data) as outlined in the Privacy Notice.

- You acknowledge and consent to airpay rafiki's verification of your Personal Data and Relevant Information as specified in the corresponding Privacy Notice and Privacy Policy.

- You acknowledge and consent to our use of automated processing to assess your eligibility for our Services based on the Personal Data and Relevant Information we collect. You have the option to object to the automated processing of your Personal Data, but this may prevent us from providing you with our Services. If you wish to request a review of an automated decision, you may contact us via email at care@airpay.tz.

- You acknowledge and agree that the Personal Data collected by airpay rafiki may be stored and processed in the United States or any other country where airpay rafiki or its agents have facilities. By using the Service, you consent to such transfer of information outside of Tanzania.

- By using the Services, you acknowledge that some of your Personal Data will be shared with Mobile Money Providers and our technology providers. You hereby grant airpay rafiki the authorization to share, provide, or disclose your Personal Data, including any Customer Information, to such third parties with whom you have separately contracted or intend to contract. Please note that you can withdraw this authorization given to us for disclosure to such third parties (excluding law enforcement, investigative, or regulatory authorities) at any time.

- You understand and acknowledge that airpay rafiki may verify your identity information through publicly available and/or restricted government databases in order to comply with regulatory requirements.

- You agree that airpay rafiki has the right to monitor your account usage and may disclose Personal Data to local law enforcement, investigative agencies, or competent regulatory or governmental agencies to aid in the prevention, detection, or prosecution of money laundering activities, fraud, or other criminal activities.

- You understand and acknowledge that airpay rafiki may verify your identity information through publicly available and/or restricted government databases in order to comply with regulatory requirements.

- airpay rafiki personnel responsible for handling Personal Data have an obligation to treat it securely, confidentially, and are prohibited from disclosing it to unauthorized third parties. Personnel who violate airpay rafiki’s privacy policies may face various disciplinary actions.

- Anyone providing information through the App may be granted access rights to that information in accordance with the Privacy Policy. You agree to promptly inform us, within thirty (30) days, in writing of any changes to your Credentials and to promptly respond to any requests from us.

- In the event that:

You do not promptly provide Customer Information as reasonably requested by us, or You withhold or withdraw any consents needed for the processing, transfer, or disclosure of Customer Information for your use of the Services (excluding marketing or promotional purposes), or We, or a member of airpay rafiki, have suspicions regarding money laundering activities, fraud, or other criminal activities and/or associated risks, We may: Be unable to provide new or continue to provide all or part of the Services to you, and reserve the right to terminate our relationship with you, Take actions necessary for us or a member of airpay rafiki to meet compliance obligations as required by Applicable Law, and/or, Block, transfer, or close your account(s) where permitted under Applicable Law.

- In addition, if you fail to supply promptly your tax Information and accompanying statements, waivers and consents, as may be requested, then we may make our own judgment with respect to your status, including whether you are reportable to a Tax Authority, and may require us or other persons to withhold amounts as may be legally required by any Tax Authority and paying such amounts to the appropriate Tax Authority.

- Through the App, you have the ability to apply for Credit Advances. The maximum credit limit for each advance will be determined based on your credit score, with your repayment history being one of the factors taken into account.

- For each Credit Advance, you will incur Interest, typically ranging between 0.36% to 3% per day of the offered Credit Advance, along with any associated Telecom Charges. Please note that Telecom Charges are beyond airpay rafiki's control.

- The Interest rate will be determined by airpay rafiki and will vary based on your credit score, but it will be subject to the maximum limits allowed by Applicable Law.

- In the event that you fail to make the required payment for the Credit Advance and Interest by the due date, we are authorised to apply a Late Payment fee of 0.5% per day, subject to a maximum of 5% of the overdue amount

- Prior to issuing each Credit Advance, airpay rafiki will provide you with details of the Credit Advance, Interest, and Late Payment Interest that apply to you.

- You are obligated to repay the Credit Advance along with the corresponding Interest according to the repayment schedule outlined in the App when we offer you the Credit Advance.

- You hereby commit to making all payments associated with your use of the Services. All payments under this Agreement are to be made in full, without any setoff or counterclaim. Unless otherwise required by law, payments are to be made free and clear of any deduction or withholding. If you are obliged to make any deduction or withholding from a payment to us, you agree to promptly remit additional amounts to ensure we receive the full amount we would have received without such deduction or withholding.

- You agree to cover all other fees, expenses, taxes, duties, charges, and costs incurred in fulfilling your Requests.

- You agree to cover the costs, charges, and expenses incurred by us in securing or attempting to secure payment of any Credit Advance owed by you.

- An Event of Default occurs when you fail to make a payment for the Credit Advance issued to you under this Agreement within the period specified on the Credit Advance Offer Page provided to you when you accepted the terms of the Credit Advance. The only exception to this is if the failure to pay is solely due to an administrative error or technical problem beyond your control.

- In the event that an Event of Default has occurred and is ongoing, you agree and give consent for us to, without prejudice to any other right or remedy granted to us under any law:

- Declare that the Credit Advance (along with all accrued interest and any other outstanding amounts under this Agreement) is immediately due and payable, whereupon they will become immediately due and payable; and

- Provide information regarding the Event of Default to Credit Reference Bureaus in accordance with our Privacy Policy, after giving you seven (7) days' notice

- Engage an external collections agency to pursue repayment

- Seek indemnification upon demand for any reasonable loss or expense incurred by us as a result of an Event of Default; and/or

- erminate this Agreement in accordance with Section 14 below.

- If we report negative information to Credit Reference Bureaus, we will notify you of this within 30 days of us submitting such information. Upon written request to us via email at care@airpay.tz, a copy of any adverse information about you sent to a Credit Reference Bureau will be made available to you.

- You understand that if airpay rafiki provides information about you to Credit Bureaus, it may have an impact on your credit profile and potentially affect your creditworthiness and credit scores

- The payments required of you under this Agreement are calculated without factoring in any taxes that may be due from you. If any taxes are applicable to the payment, you must remit to us an additional amount equivalent to the payment multiplied by the applicable tax rate. You are required to do so at the same time as making the payment.

- You hereby provide your consent and agreement that we may withhold amounts from your Account if any tax authority mandates such action, or if we are otherwise obligated by law or under agreements with tax authorities to do so. This action may also be taken if we need to adhere to internal policies or comply with any relevant directive or sanction issued by a tax authority.

- Upon your Request, a statement and activity report for your Credit Advance can be provided to you. Please reach out to us through the App or via email at care@airpay.tz. 9.2. Your statement will display all the details of the latest Credit Advance transaction, or as otherwise determined by us, initiated from your Equipment. It is important that you review your statement carefully and promptly notify us if you identify any transaction or entry that appears to be incorrect or not in line with your instructions

- We retain the right to correct discrepancies, add, and/or modify entries in your statements, without prior notice to you. However, we will inform you of any corrections, additions, or alterations made to your statements within a reasonable timeframe after the changes are implemented.

- With the exception of a clear and obvious error, a statement issued to you regarding your transactions will serve as conclusive evidence of the transactions carried out and requested by you from your Equipment for the period covered in the statement.

- You agree to receive notifications from us regarding (i) important matters related to the Services or transactions that may concern you, and (ii) marketing messages about the Services. You consent to receiving notifications through our App, as well as via SMS and emails sent to the email address and mobile phone number provided by you during the registration process.

- At any point, you have the option to opt-out of receiving direct marketing communications from us by contacting us at care@airpay.tz. Additionally, you can use the unsubscribe instructions provided in any email/SMS communications sent to you. For App notifications, you can disable them at the device level through your settings or within the mobile application settings within the App.

- If you uninstall the App from your Device, you can revoke your consent for airpay rafiki to access your Customer Information in the future. However, you acknowledge and consent that we may retain and share the Customer Information you provided up until the point of uninstallation for as long as it is necessary to fulfill the purposes for which the Customer Information was obtained, or for legal claims, legitimate business purposes, or as permitted by law.

- You grant Us authorization to act upon all Requests received from you (or purportedly from you) via the System. You accept liability for such Requests, even if, in our absolute discretion, We believe that we can rectify any incomplete or ambiguous information in the Request without requiring further input from you.

- We will be considered to have acted appropriately and fulfilled all obligations owed to you, even if the Request was initiated, sent, or communicated in error or through fraudulent means. You are bound by any Requests on which We act in good faith, under the belief that such instructions were sent by you.

- You understand that, at our sole and absolute discretion, we may choose to decline carrying out certain Requests, including the right to reject any Credit Advance application from you, even if you have previously received a Credit Advance from Us.

- You agree to release and indemnify Us from any claims, losses, damages, costs, and expenses arising from or related to Our actions (or inactions) in accordance with all or any part of your Requests.

- You acknowledge that, to the maximum extent permitted by law, We shall not be held liable for any unauthorized activities on your account, including drawing, transfer, remittance, or disclosure, due to the knowledge and/or use or manipulation of your Account PIN, password, ID, or any means, whether or not caused by your negligence.

- We are authorized to carry out orders concerning your Credit Advance and/or Account as may be required by any court order or competent authority or agency under applicable laws.

- In the event of any conflict between the terms of any Request received by Us from you and this Agreement, this Agreement shall take precedence.

- You agree to the following

- You will, at your own expense, provide and maintain your Equipment in safe and efficient operating order for accessing the System and the Services.

- You will ensure the proper performance of your Equipment. We shall not be held responsible for any errors or failures caused by any malfunction of your Equipment, nor for any computer virus or related issues associated with the use of the System, the Services, or the Equipment.

- You will be responsible for any charges owed to any service provider that grants you access to the Network. We are not liable for any losses or delays caused by such service providers.

- You will adhere to all instructions, procedures, and terms outlined in this Agreement, as well as any document provided by Us regarding the use of the System and the Services.

- You will be solely responsible for the secure keeping and proper use of your Equipment, and for maintaining the confidentiality of your Credentials. You must ensure that your Credentials remain unknown and inaccessible to any unauthorized individuals. We are not liable for any unauthorized disclosure of your Credentials, and you agree to indemnify and hold Us harmless from any losses resulting from such disclosure.

- You will take all reasonable precautions to detect any unauthorized use of the System and the Services. You will ensure that all communications from Us are promptly examined and verified by you or on your behalf upon receipt, in a manner that allows for the detection of any unauthorized access or use of the System.

- You will not operate or use the Services in any manner that may be detrimental to Us.

- You will adhere to the security procedures communicated to you by Us from time to time, or any other procedures applicable to the Services at any given time. You acknowledge that any failure on your part to follow the recommended security procedures may lead to a breach of your Account’s confidentiality. Specifically, you will ensure that the Services are only used, Requests are only issued, and relevant functions are only performed by authorized personnel.

- Additionally, you agree to promptly notify Us in the event that:

- You have reason to believe that your Credentials are known to an unauthorized person or have been compromised; and/or

- You suspect or become aware of any unauthorized use of the Services, or if a transaction may have been fraudulently input or compromised.

- We reserve the right to terminate our business relationship with you and close your Account at any time, and specifically, but not limited to, we may cancel any granted Credit Advances and request repayment of outstanding debts resulting from such Credit Advances within a timeframe determined by Us, upon notifying you.

- Additionally, at our sole discretion, We may suspend or close your Account if:

- We identify or reasonably suspect any abuse/misuse, content breach, fraud, or attempted fraud related to your use of the Services

- We are required or instructed to comply with an order, directive, or recommendation from the Government, Court, regulator, or other competent authority

- We reasonably suspect or believe that you have violated this Agreement (including non-payment of any owed Credit Advance amount) and you fail to rectify it (if remediable) within five (5) days after receiving notice via email, SMS, or other electronic means

- Such a suspension or modification is necessary due to technical issues or safety concerns, or to facilitate, update, or enhance the contents or functionality of the Services

- Your Account becomes inactive or dormant

- You breach any of the License Restrictions

- Your Account or the agreement with the Mobile Money Provider and/or Mobile Network Provider is terminated for any reason; or

- We decide to suspend or cease providing the Services for commercial or other reasons

- Termination will not affect any accrued rights, remedies, and liabilities of either party.

- In the event of your passing, we are not obligated to allow any operation or withdrawal from your Account unless accompanied by official documentation, such as administration letters from a competent authority, or confirmed grants of letters of administration or probate from your legally appointed representatives as determined by a court of competent jurisdiction.

- Should your Account hold a credit balance due to an overpayment of your Credit Advance, you may request airpay rafiki for reimbursement of such balance, which will be returned to you, minus any applicable charges. This amount should exceed the minimum transfer amounts specified by the relevant Mobile Money Provider.

- We shall not be held responsible for any losses you may incur due to the Services being disrupted or unavailable as a result of factors beyond airpay rafiki’s control. These include, but are not limited to, Force Majeure events, technical failures of your Equipment, or any other unforeseeable circumstances, such as terrorist actions, equipment malfunctions, power outages, adverse weather conditions, legal operations, or the failure of public or private telecommunications systems.

- You acknowledge that the App has not been tailored to meet your specific requirements, and it is your responsibility to ensure that the features and functions of the App, as described, align with your needs.

- The App is provided solely for personal and domestic use. You agree not to use the App or associated documents for any commercial, business, or resale purposes. We bear no liability for any loss of profit, business interruption, or missed business opportunities.

- We shall not be liable for any losses or damages you may experience due to:

- Any defects or faults in the App or any Service resulting from alterations or modifications made by you;

- Any defects or faults in the App resulting from your use in violation of the terms of this Agreement;

- Your breach of any License Restrictions;

- Insufficient funds in your Mobile Money Account;

- System, Equipment, Network, or Mobile Money System failure, malfunction, interruption, or unavailability;

- Legal processes or encumbrances restricting payments or transfers from your Account;

- Inadequate or incomplete payment or transfer instructions related to our Account;

- Any fraudulent or unlawful use of the Services, System, or your Equipment; or

- Your failure to comply with this Agreement or any documents or information provided by Us regarding the use of the System and Services.

- We shall not be liable for any interference with or unavailability of the Services, regardless of the cause. Under no circumstances will We be liable for loss of profit, anticipated savings, or any indirect or consequential loss or damage of any kind, even if the possibility of such loss or damage has been communicated to Us.

- Our sole liability under this Agreement for Service interference or unavailability shall be limited to restoring the Services as soon as reasonably possible, except where such restoration is not commercially viable or is beyond airpay rafiki’s control. This includes instances of Force Majeure, technical issues, interruptions, delays, or unavailability of the System, terrorist actions, equipment failures, power loss, adverse weather or atmospheric conditions, legal operations, and failures in public or private telecommunications systems.

- Except as provided in Section 15.6, We shall not be liable for any interference with or unavailability of the Services, regardless of the cause.

- All warranties and obligations implied by law are hereby excluded to the fullest extent permitted by law.

- The microfinance company reserves the right to accept or reject any rollover application at its sole discretion.

- The microfinance company may withdraw the rollover facility at any time, with or without prior notice, at its discretion.

- Loans that have crossed 90 Days Past Due (DPD) are eligible for rollover.

- Borrower must have not opted for loan rollover facility in the past from airpay microfinance.

- Borrowers must pay an upfront rollover fee of 5% of the outstanding loan amount plus applicable taxes, if any.

- The entire outstanding loan amount will be converted into three equal, non-interest-bearing Equated Monthly Instalments (EMIs).

- The EMIs will be payable on a monthly basis.

- If the borrower fails to pay any of the restructured EMIs and said defaults continues for 90 days from the due date the entire loan shall be written off.

- An upfront rollover fee of 5% of the outstanding loan amount plus applicable taxes must be paid by the borrower to initiate the rollover process.

- Restructured schedule as displayed shall be valid only after payment of rollover fee along with applicable taxes, if any.

- The instalments for repayment of the restructured loan amount must be realized by the microfinance company on or before the agreed date of repayment.

- The loan account will continue to accrue interest and penal charges as per our existing policy until the last payment is made in full. After all payments are realized, reversals and waivers will be processed as per the rollover agreement.

- The rollover terms are in addition to, and not in derogation of, the original Loan Agreement and the Terms and Conditions governing the loan.

- This rollover offer is issued without prejudice to the microfinance company’s right to continue all legal proceedings pending against the borrower in connection with the loan account until the entire dues are paid in full, either as per this rollover or the original agreement.

- This restructuring offer is exceptional and should not be quoted as a precedent for any other loans.

- The restructured amount shall be accepted as full and final settlement of the loan account. Upon receipt of the restructured amount, a No Objection Certificate (NOC) will be issued, provided the borrower does not owe any direct or indirect liability to the microfinance company.

- The offer is valid for one week from acceptance of the offer on the app, after which it becomes null and void.

- If the repayment schedule is not adhered to, the rollover offer will be null and void. The borrower will then be required to pay the entire outstanding amount, and any amounts paid under this rollover offer will be adjusted towards the total dues as per the original agreement. The microfinance company reserves the right to initiate legal action on dishonoured cheques.

- By endorsing this rollover offer letter, the borrower unconditionally agrees to withdraw all cases filed against the microfinance company regarding the loan agreement. Failure to do so will render this rollover offer letter null and void.

- Any refund will be processed only after adjusting dues outstanding in other loan or products. In case of money received through insurance, any excess amount will be refunded only after adjusting dues in other loan products.

- The borrower must sign a copy of this rollover offer letter as acceptance of the Terms and Conditions of the rollover program.

- Information on loan repayment will be shared with the Credit Bureau or other credit rating agency or regulatory body.

- In exchange for Us carrying out your instructions or Requests regarding your Account, you agree to indemnify and hold Us harmless from any loss, charge, damage, expense, fee, or claim incurred or sustained by Us as a result. You also release Us from any liability for losses or damages you may incur from Us acting upon your instructions or requests in accordance with this Agreement.

- This indemnity also extends to the following:

- All demands, claims, actions, losses, and damages of any kind that may be brought against Us, or that We may incur, arising from our action or inaction in response to any Request, or from the malfunction, failure, or unavailability of any hardware, software, or equipment, as well as the loss or destruction of any data, power outages, corruption of storage media, natural disasters, civil unrest, acts of vandalism, sabotage, terrorism, or any other event beyond Our control. It also covers interruptions or distortions in communication links, or reliance on any person, or any incorrect, illegible, incomplete, or inaccurate information or data contained in any Request received by Us.

- Any loss or damage that may arise from your use, misuse, abuse, or possession of any third-party software, including, but not limited to, any operating system, browser software, or any other software packages or programs.

- Any unauthorized access to your Account, breach of security, or any unauthorized access or theft of your data, or any damage to your Equipment.

- Any loss or damage resulting from your failure to adhere to this Agreement and/or providing incorrect information, or loss or damage resulting from the failure or unavailability of third-party facilities or systems, or the inability of a third party to process a transaction, or any loss incurred by Us as a result of a breach of this Agreement.

- Any damages and costs payable to Us in respect of any claims against Us for compensation for loss where the particular circumstance is within your control.

- Should you need to communicate with us in writing, or if any provision in this Agreement necessitates you to provide us with notice, you may do so via email at care@airpay.tz. We will acknowledge receipt of your message by reaching out to you in writing through email.

- In the event that we need to get in touch with you or issue written notices, we will do so through email or via SMS to the mobile number or email address you have furnished us with in your App request.

- The failure of any party to exercise, or any delay in exercising, any right, power, or remedy provided by this Agreement or by law shall not constitute a waiver thereof. Furthermore, any single or partial exercise of such right, power, or remedy shall not hinder any further or alternative exercise of that, or any other, right, power, or remedy

- Our failure to exercise, or any delay in exercising, any right or remedy in connection with any provision of this Agreement shall not be considered a waiver of such right or remedy.

- If any provision or part of a provision of this Agreement is, or is found by any court of competent jurisdiction to be, invalid or unenforceable, it shall not affect the validity or enforceability of the remaining provisions or parts of such provisions, all of which shall remain in full force and effect.

- We reserve the right to modify or amend these Terms and Conditions at any time without prior notice. Such changes may be communicated through various channels including the App, newspapers, social media, our website, or any other means as determined by us. Any such alterations and amendments shall take effect immediately upon publication.

- If any provision of these Terms and Conditions is determined to be invalid or unenforceable by any duly appointed arbitrator, court, or administrative body of competent jurisdiction, the invalidity or unenforceability of such provision shall not affect the other provisions herein.

- You agree not to assign, transfer, sub-contract, delegate, charge, or otherwise deal with any of your rights or obligations under this Agreement.

- You acknowledge that we may assign and transfer any of our rights and obligations under this Agreement to third parties at our discretion.

- These Terms and Conditions constitute the entire agreement between you and us, supplanting all prior agreements, promises, assurances, warranties, representations, and understandings, whether written or oral, pertaining to its subject matter.

- By entering into this Agreement, you affirm that you do not rely on any statement, representation, assurance, or warranty (whether made innocently or negligently) that is not expressly set out in this Agreement

- Both parties agree that neither shall have any claim for innocent or negligent misrepresentation or negligent misstatement based on any statement in this Agreement.

- airpay rafiki strongly encourages you to report any disputes, claims, or discrepancies by contacting us via email at care@airpay.tz.

- In any case, you agree to make a good faith effort to resolve any dispute, controversy, or claim arising from or relating to this Agreement.

- This Agreement will be governed by and interpreted in accordance with international arbitration laws and the laws of the Republic of Tanzania, without giving effect to any choice or conflict of law provision. However, matters concerning the interpretation and impact of any Intellectual Property Right(s) will be determined by the laws of the country in which the Intellectual Property Right(s) were granted.

- "Agreement": This refers to the contract you are currently reading

- "Account": This pertains to your registered account with airpay rafiki.

- "Credentials": These are the personal details you use to access the airpay rafiki App and manage your Account.

- "Credit Advance": This signifies a loan extended by airpay rafiki to you.

- "Credit Bureau": This is an officially licensed institution under the Banking and Financial Institutions Act, mandated to collect and facilitate the sharing of customer credit information.

- "Credit Advance Offer Page": This is a page outlining the specific terms, conditions, and features of any loan offer.

- "Customer Information": This encompasses your Personal Data, Sensitive Personal Data, Health Data, and/or Tax Information, including relevant details about you, your transactions, your use of our products and services, and your associations with airpay rafiki.

- "E-Money": This represents the electronic monetary value depicted in your Account, equivalent to a corresponding amount of cash.

- "Equipment": This encompasses your mobile phone handset, SIM Card, and/or other devices that, when used together, enable you to connect to the Network.

- "Force Majeure": These are unforeseeable events or circumstances beyond reasonable control that render the performance of obligations impractical, illegal, or impossible.

- "Encumbrance": This includes any form of security interest, lien, pledge, or other restrictions securing any obligation.

- "Interest": This denotes the charges applied by airpay rafiki to the loan provided to you.

- "Late Payment Interest": This refers to the additional interest imposed if you fail to make timely payments to us.

- "Loan": This is the principal amount of the loan granted or to be granted by airpay rafiki to you under this Agreement, including any interest and/or other charges.

- "Mobile Money Account": This is your mobile money store of value, maintained by Mobile Money Providers, reflecting the amount of E-Money held by you in the Mobile Money Provider’s System.

- "Mobile Money": This refers to the money transfer and payment service offered by Mobile Money Providers.

- "Mobile Money Service": This denotes the money transfer and payment service provided by the Mobile Money Providers through their respective system.

- "Mobile Money System": This is the system operated by the Mobile Money Providers for the provision of the Mobile Money Service.

- "Mobile Network Operator" or "Mobile Money Provider": This denotes a mobile network operator registered with the Tanzania Communications Regulatory Authority.

- "Network": This signifies a mobile cellular network operated by a Mobile Network Operator.

- "Personal Data": This encompasses personally identifiable information as defined in the Personal Data Protection Act, including but not limited to various details about an individual.

- "Privacy Notice": This is the document available within the airpay rafiki App and on the airpay rafiki website that outlines the Personal Data collected from you and its intended use.

- "Privacy Policy": This is the airpay rafiki Privacy Policy available within the airpay rafiki App and on the airpay rafiki website, specifying how any personal data collected from you will be stored and processed.

- "Relevant Information": This refers to information necessary for airpay rafiki to provide the Services, including data related to your phone, SMS messages, and any other information specified in the relevant Privacy Notice.

- "Request": This is a request or instruction received by airpay rafiki from you or purportedly from you through various channels, upon which airpay rafiki is authorized to act.

- "Sensitive Personal Data": This includes data revealing sensitive information about an individual's identity.

- "Services": This encompasses various services or products that airpay rafiki may offer you within the App as per this Agreement.

- "SIM Card": This is the subscriber identity module used in conjunction with the appropriate mobile phone handset to access the Network and use the Mobile Money Account.

- "SMS": This refers to a short message service consisting of a text message transmitted from your mobile phone to another.

- "System": This denotes electronic communication software enabling you to communicate with airpay rafiki for the purpose of the Services.

- "Technology": This includes services supported or utilized by the App.

- "Telecom Charges": These are distribution costs for telecom network services, paid directly to your telecom provider.

- "Terms and Conditions": This collectively refers to this Agreement along with the Privacy Policy, Privacy Notice, and the Credit Advance Offer Page.

- "User": This pertains to a mobile network subscriber who has successfully installed the App and registered for the use of the Services.

Rafiki Customer Care Details:

Customer Care Number - +255 699 999 300

Customer Care Email Id – care@airpay.tz